Christine was in my office today. She picked up our bankbook and was looking at it. Of course, she wanted to know how much was in the bank. That’s when I realized how many people just look at their bankbook or their account statement to figure out their financial situation. This is perhaps at best an inadequate view of your financial accounts or at worst downright erroneous. Why?

In today’s food for thought article, I’m going to answer why in several ways and explore an easy way to find out a better picture of your current financial health. But first, why is it inaccurate?

Assets: Or how to cover yours!

In short, the money that is present in the bankbook isn’t necessarily the money you actually have. It doesn’t take into account money that you may have in other places: your house, your insurance policy, your investment accounts, your savings accounts, your piggy banks, or wherever there could be a store of value. In other words, your bankbook as personal financial statement may seriously underestimate the actual worth of your holdings, ie. your assets.

In order for you to work out your total assets (the total amount of money or ‘value’ that you have stored up), you will need to consult numerous documents: in fact, for my own personal financial statement, I need to consult about fifteen or so individual accounts or statements to find out this value.

For the first time, simply collate all the accounts together that you need to use. Then divide them into assets (money you have) and liabilities (money you owe). Let’s deal with the assets first.

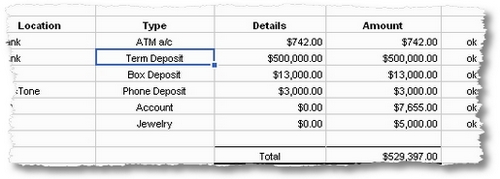

List each item in a spreadsheet and its value. Here is an example from my notes with all numbers in NT$ (not US$!).

It’s not perfect, but shows you how you could do. Simply add up the total to arrive at a value of your net assets. You need to be conservative on this figure if there’s uncertainty anywhere. Typical uncertainty may lie in insurance policies (where payouts might be less!), value of jewelry or expensive items, etc. Always try to use a conservative number, such as the least you could get.

Liabilities: You’re still on the hook

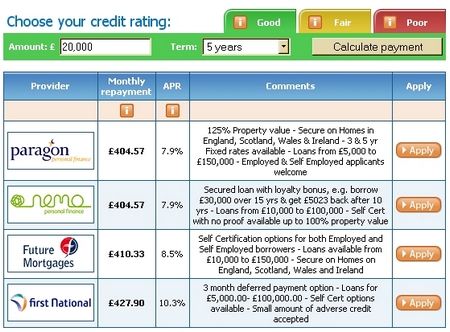

The same listing technique can be used as above but for your liabilities. Remember: liabilities are the money that you OWE to other people. Typical examples include: mortgages, credit card debt, car loans, student loans, etc.. If there is any uncertainty about amounts, you should always use the more aggressive (or larger) amounts to remove any risk of misjudging how much you have.

So dig out all your current payment statements, and list them as above. It might be a good idea if you have multiple sources to sort them into three categories: house and car loans, credit cards, and personal loans. That way you will have a better idea where the largest amounts of money are. (You may also wish to see what the current APR is on these deals!).

Networth is easy: Assets Minus Liabilities

Now you can figure out your networth with this easy formula. And the answer is easy: if your networth is positive, things are looking up. You’re actually creating your own wealth. If your networth is negative, then you need to be looking at the source of your liabilities: where are you spending? Both categories should be encouraging you to increase your assets. That’s how debts are erased.

Example A: A mid-30’s couple has US$145,000 in assets (from a house, car, savings and pensions) but their liabilities are also big with $130,000 (from a mortgage, car loan, outstanding loan payments, credit card debt, and student loans). Therefore, their net worth is currently $15,000.

Example B: A single young lady aged, 29 has only US$4,500 in the bank (no house, no pension plan, no investments) but she has credit card and personal loans of $7,500 outstanding. Her networth is $-3,000 or negative $3,000. In other words, her lifestyle is consuming more and more of her salary. If she’s not careful, more and more of the regular payments will be to pay off interest charges.

I’ve been calculating my networth for more than 15 years now, and it has really helped to clarify our own financial decisions. I don’t do it very often as things don’t change that much, typically every quarter or even six months now is fine. But when you start out, you may want to do it more often to get a sense of the direction the networth is going.

Do let me know if I missed anything. How do you calculate your networth?