This series of posts will look at my purchasing mistakes I made for the limited amount of trading that I have actually. I will look at the entire record, and try to thrash out what lessons there are for investors.

Now bearing in mind that I have traded since 1998 online, I will struggle to remember my actual decisions, rationale, and performance. Who knows what we’ll find out. I hope that it will be useful to all investors.

A Simple Formula

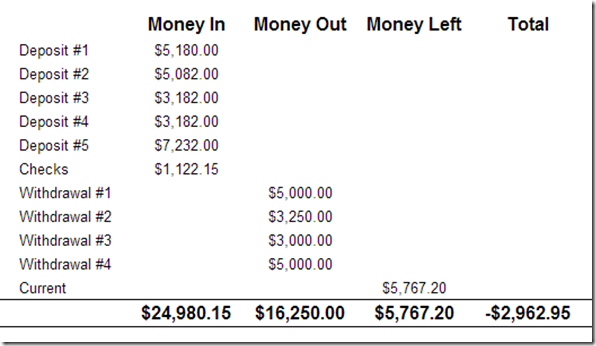

Though since that time there have been dividends and other stock successes, the crude method of working out my return is Money Out+Money Left-Money In=?

Let’s look at the details: Since September 1998, I have deposited $24,980.15 into my trading account at TDAmeritrade.

During that time, I’ve also made withdrawals (to pay for the deposit on our house, to cover unexpected costs, etc.), the total withdrawals are $16,250.

And the remainder in my account is currently $5,767.20. The grand total doesn’t include wiring fees, taxes, etc.. Nor I’m sorry to say, because I live in Taiwan, does it include exchange rate losses/gains.

Simple math will show that I’ve incurred a gross loss $2,962.95 in those 16 years in the stock market. Truthfully, I’ve not been invested all of those years; and since 2010 I’ve been largely in cash anyway. This cash has been earning a measly 0.01% return (or something equally pathetic).

It would be hard to work out the actual profit across the time, but the numbers do tell the simple story. Money Out+Money Left<Money In. Therein lies the problem.

So what did we learn during that time?

That risking capital trading in the stockmarket is foolhardy, you will NEVER (as a private small time investor) EVER be able to be ahead of the BIG BOYS in trading the news.

That Return OF your Capital is always better than Return On your Capital. IOW, you need some ‘margin of safety’, some edge, some qualitative advantage that enables you to get back your capital. Trading the DOW 30 or the NASDAQ is always going to be risky. As we know, even BIG companies (like GM, BAC, Citbank, …) can have their ass handed to them on a plate; if you paid too much for them, or put on your rose-tinted specs too soon, you’ll be looking for your ass, too.

I’ve made a lot of mistakes regarding Bulls, Bears, Bubbles, Bounces, and … whatever other B-word I can think of. Why? Because I trusted other people’s advice, other’s people’s guts, other people’s news… in the stock market, I’ve come to realize, it always pays to do your homework. And never be swayed by the newspapers or CNBC or the Stock Forums or…

Lastly, if it weren’t for my businesses, house & other smaller investments increasing in value, I’d be doubly depressed. In other words, your stock market investing can never be your only or even your major investment. The markets are too speculative, too rigged, too capricious, and Mr. Market always seems to be wondering who he can ream next. Hint: it’s you!

I’ll be returning with a look at the batting average for each of those years from 1998~2014. And a few ideas about what I might be doing next.