What Type Of Companies Pay Dividends?

To find good dividend stock picks, look for a long, solid history of the company.

When you look for things like this, you are doing a type of research called fundamental analysis. Fundamental analysis is basically the study of a company’s fundamentals.

The other type of stock search is called technical analysis. This is mainly the study of a company’s price chart. But don’t worry, for dividend stock investing, you wont need to learn any technicals.

Companies that are steadily growing or rapidly growing are less likely to pay dividends. These companies are wise stock investments for the long term, just not for dividends. When a company is growing, it is wise for the company to re-invest they’re earnings back into themselves.

Larger companies often do offer dividends. This is sometimes taken as a sign that the company has exhausted all it’s options for growth. It can also be taken as a sign that the company has faith in it’s future.

Getting The Most For Your Money

When choosing your stock picks, it may seem obvious that you would want to choose the one with the greatest return on your investment, right? For now, lets just say yes.

Another important thing to look for is dividend growth.

This is when the dividends paid out increase at a certain percentage over time. So, like most investment strategies that I have discussed in previous articles, you must decide what is best for you. Higher payout now or higher payout later?

Picking The Perfect Payment Schedule… Five Times Fast

As well as looking at the above two factors when determining your dividend stock picks, you should also consider how often dividends are paid out.

Often dividends are paid out a few times a year. Some companies also surprise they’re investors with extra payouts.

Not As Easy As 123

There are a few more things I would like to discuss with you when choosing your dividend stock picks. From there, you should be armed with enough information to get started.

I have skimmed over a few important things to look at when choosing you dividend stock picks. It may seem all fine and dandy up till now. But, heres the nitty gritty of it.

Will I Actually Get My Dividend Payment?

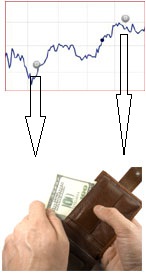

As I said before, high dividend-paying stocks are more attractive. But, there is a flip side to that.

Let me start by saying, it would be wise to choose a stock that will be paying dividends on a consistent basis in the foreseeable future.

When a stock is paying very high dividends, this should throw up a red flag. You should be aware that this company has a better chance of missing a few payments throughout the year (this would be scary) than a company that is conservative with they’re payments.

When a company misses a promised payment, this damages the trust in the company. Think about it, you want your money, right?

This trust may take years to gain back. Companies know that. So, the good ones try extra hard to manage they’re money wisely in order to continue paying dividends on a scheduled basis. Thus, building they’re shareholders’ faith.

This is why often, steady companies that look promising don’t pay such high dividends. So, take the good with the bad and find a cozy medium that works for you.