Credit Cards provide a convenience, a record and many valuable services for their members, not including the actual revolving loan features. When you consider the loan facilities typically provided, it is easy to see why credit cards have replaced checks and debit cards have not been as popular. In fact, credit cards have replaced even cash on most larger purchases. I daresay there are even people who bought a cappuccino on a credit card! So credit cards are perhaps the most convenient way to keep up with the demands of the modern society and as anyone who likes shopping knows, it’s much easier to sign a credit card voucher than fumble for coins and notes in your wallet or purse!

With so many different types of credit cards available,CardGuide offers a website that helps UK users find good credit card deals. CardGuide recently purchased a link on this website, and in return, I promised a review of their website as a way to say ‘thank you’. As you know, this is a good deal for them: they get a year’s link plus a permanent entry on my blog. Blog entries really do help backlinks and PR rankings.

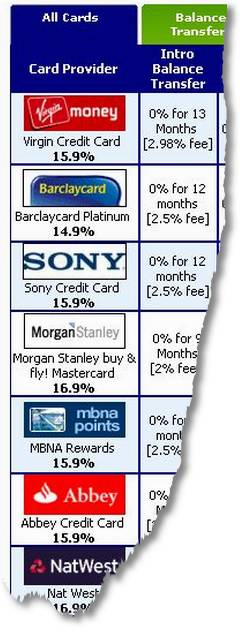

CardGuide’s Raison-d’etre is the list of credit cards that they offer  as you will see from the graphic below. In fact, the database allows viewers to rank and sort the available choices by the type of features that they are looking, say, 0% offers , cashback, etc. It works quickly and intuitively just and the page seems to reload quickly, too, so visitors will find that this tool simple and natural. The results are laid out in a table below, with information about each of the offers and an apply now button on the right. Of the four offers that I clicked, I was taken to application forms as promised in each case. This might seem a dumb thing to say, but in a recent review, a similar website advertising loans couldn’t keep their information uptodate. In fact, many of the loans were withdrawn. It’s important to keep information timely for this kind of business, otherwise potential clients will simply walk. In addition, to the offers, there are a number of credit card articles that are worth reading, and unique to the site. A google search revealed that several of the articles were in fact unique to this site.

as you will see from the graphic below. In fact, the database allows viewers to rank and sort the available choices by the type of features that they are looking, say, 0% offers , cashback, etc. It works quickly and intuitively just and the page seems to reload quickly, too, so visitors will find that this tool simple and natural. The results are laid out in a table below, with information about each of the offers and an apply now button on the right. Of the four offers that I clicked, I was taken to application forms as promised in each case. This might seem a dumb thing to say, but in a recent review, a similar website advertising loans couldn’t keep their information uptodate. In fact, many of the loans were withdrawn. It’s important to keep information timely for this kind of business, otherwise potential clients will simply walk. In addition, to the offers, there are a number of credit card articles that are worth reading, and unique to the site. A google search revealed that several of the articles were in fact unique to this site.

Challenges

There are three challenges, some of which are easy to remedy, but the first one is perhaps not so easy.

Perhaps the UK Credit Market is smaller, but there weren’t that many credit card offers, and once ranking by feature was introduced, the number of choices was further limited. Also, I noted that there were quite a few major banks not represented in the list, including HSBC. Obviously, part of the problem is that credit card offers aren’t always available, as they are special offers! The counterbalance is that the information seems very fresh, although choice is more restricted. If your customers aren’t attached to a particular provider then for the webmaster, this shouldn’t be a problem. I don’t know if the webmaster is working with one or more affiliate programs, like Commission Junction, but it would be a good idea to look at others, too.

I noted that the website has a newsletter feature that users can subscribe to, as well as RSS feeds. Both of these really will help to bring back users to the website but please give these prominence. Both of them are tucked away at the bottom of the page. Can these go at or near the top of the page? I think subscribers are more likely to find them there than elsewhere!

Your Google Ads could be better placed. Obviously, the Google Ads could be seen as competitors in some respects to your affiliate links. Larger google boxes like the square or rectangle boxes placed alongside the text (like the graphics in this review) would result in more click-throughs for Adsense, and higher Adsense Revenue. Also, you should place the Ads (whichever form) above the crease. In many cases, this will lead to a higher CPC ratio. Google Ads seem to ‘know’ where they are on a page.

Lastly, and most importantly, get a Privacy Policy on your website. A link next to your sitemap will suffice, but a clear statement of your privacy terms will increase the confidence levels of your visitors, even if they don’t visit it. Also, as I found out from Commission Junction, not having a privacy policy on my websites limits the offers that I can receive from financial institutions, many such institutions are restricted by their own rules from dealing with sites that do not offer a privacy policy. My own blog really needs one, too. In fact, if you collect any kind of personal information, including names, email addresses, etc., you really should have one. I’m working on mine at the moment.

Summary

Overall, this is a nicely laid out website, very responsive with fresh offers and unique articles. For the webmaster, finding more juicy offers and improving your ads/rss/subscriptions placements on the site should result in much higher traffic, returns and click throughs on both ads and applications.

Sponsored Post.