This post is the second in my series of buzzes for blogs in 2008!

In 2006, Craig contacted me about helping him host his website and gallery. With the changes at Flickr, this is looking like a smart move on his part… esp. if Microsoft get their hands on Flickr. They’ll surely kill it, just as they destroyed HoTMaiL.

Since then he’s been building his gallery with lots of wonderful pictures. He tried Gallery, then PixelPost before settling on CopperMine in the current configuration. Since the addition of his blog, his traffic has been building gradually as people find his website and gallery. He regularly asks for advice and suggestions on his blog, plugins, themes, and stuff. It’s fun to see how he builds his blog a little every day.

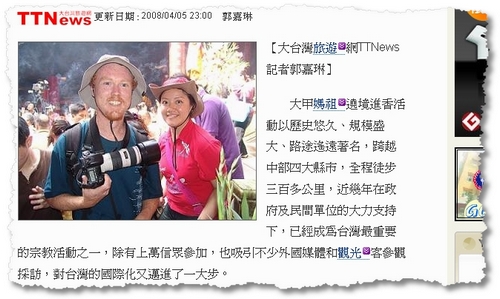

So, it was great to see that he’d been published in a local newspaper (hey, all publicity helps!)

I’m sure he’ll be tickled pink when he sees the Google News page in Chinese… He’s there, too!

The article roughly says that Mr. Ferguson has been involved in activities of the Tachia Matsu Festival for four years and that he is quite interested in religious activities here, including “the surging crowds, the beautiful temple architecture, the tour of inspection ceremony, puppet shows and even special performers and performing groups” all of which he captures on his camera. The photographs are delicate, moving and accurate representations for the events. (Sorry for my poor translation skills!).

Way to go! Pity you didn’t mention your website! Oh, well there’s always next time!

Some recent posts from Craig’s blog

- Partying with the Blues after the results of Taiwan’s election;

- Mazu Madness on the recent trip of Matzu to the island (an annual event!);

- Tour de Taiwan 2008 – Stage 8 – highlighing Taiwan’s rediscovery of the bicycle; and

- Lightroom 2.0 beta – looking at what’s new and a Tech related post for those looking for digital imaging software.