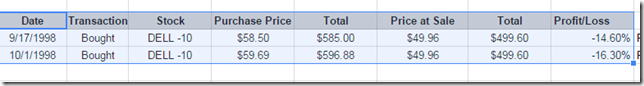

Looking back on my history of stock buys is proving enlightening. In the first year, I bought five stocks, and had losses with two. Each of the losses was quite minor so I reckon I actually made some money in 1998. Well, except that 1998 isn’t done yet. Hah!

Four days before Christmas I bought three more stocks.

International Paper, Caterpillar and Athome. So let’s look at all three.

Excite@Home (ATHM)

ATHM is the old ticker symbol for AtHome Corp, which provided (what was then) hi-speed cable Internet access as a joint venture. Unfortunately, it merged with Excite in 1999 and the stock price soared to $128 in early 1999 to just $1 in late 2001 when it entered bankruptcy. It was a wild ride!

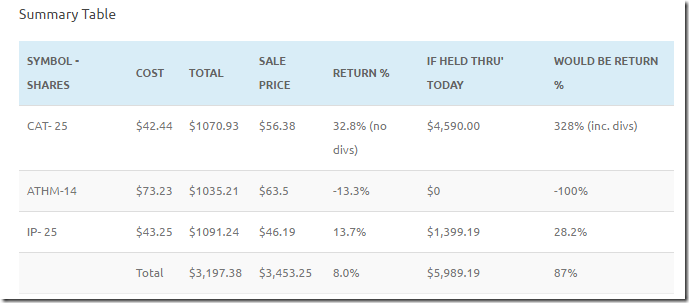

So how did I do, picking this piece of Internet dream? Purchased at $73.23, when it was all the buzz in early 1999, I finally sold out at $63.50 for a 13.3% loss of capital. Fortunately for me, I got out early before Excite@Home really crashed and burned. Still a 13.3% meant that for my investment, I lost $156.29! Boo-hoo!

I seemed to have realized that in March 2000, this one wasn’t coming back! Well spotted!

Caterpillar (CAT)

Now this was a more interesting buy, because CAT is still around these days!

In fact I went on to buy CAT twice and sell it twice, each time I pocketed some cash! Let’s take a look at the first attempt. I bought 25 shares at $42.44 and held htem for about 10 months before selling out at $56.38. The astonishing fact with CAT is if I’d held it through to today, it would have grown over 328% in that time, before tax and dividends NOT reinvested.

Even though ATHM would have gone to $0, the entire portfolio would still be up 87% in that time. That is not a great annualized return but it beats the 8% I actually got!

International Paper (IP)

International Paper’s performance was lacklustre throughout the entire, proving you can’t pick a great stock every time. But sometimes an average performance can look stellar compared to the loss of an entire stock.

I earned only 13.7% on this stock in the months that I owned it, but keeping for the entire period to today would have returned only 28.2% (before tax on dividends). Not even inflation beating, is it?

You can see the entire performance of these three stocks in the Summary Table published below.

[table id=6 /]

Watchful Waiting

There are three interesting observations: from looking at this portfolio and the first one.

Observation #1

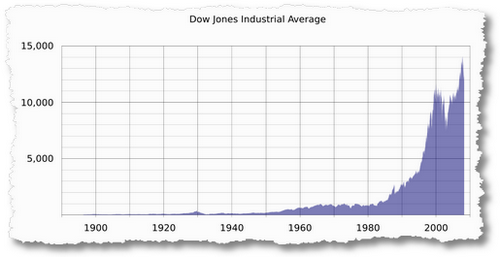

Companies go out of business quite often, even big ones. In my first portfolio, GM is now an entirely new stock after its bankruptcy. ATHM is gone; and JPM suffered in the Great Banking Crisis.

Observation #2

A portfolio can balance the excesses of #1 by offering opportunities for outsize returns: Look at the performance of CAT, MMM, and MO. Together, these two portfolios would have doubled your money over those 16 years, even if you had done nothing!

Observation #3

Frequent trading can really impact your performance; but stop & start trading like I did really doesn’t help either. Burying your head in the sand doesn’t improve your returns!

Watchful waiting might be the best way to make money even now in the stock market, research slowly, buy slowly, watch slowly, and sell carefully!

That’s 1998 done, now! The scorecard didn’t do too badly, buy & hold would’ve done even better.