This article on investing money management had me thinking about how it applies in the field of options trading. Since I started trading options, I’ve become more conservative in my risk exposure. Right now, I’m trading several times a month; and I’m using 50% of my account to trade. So it’s about 50% cash.

https://www.timothysykes.com/blog/number-1-account-killer/

Timothy Sykes writes: Any trade that you feel the need to check on constantly and after hours. Trading is fun, but it shouldn’t consume your life.

- Your losses exceed the maximum amount you allow on any given day.

- The stock has gone beyond your stop loss.

- Your typical trade size is hundreds of shares, and your current position is thousands.

His suggestions on controlling trading size, frequency, and losses will help you avoid your bad habits! But I like his ideas on keeping a journal. I thought InvestorBlogger might be that journal! But alas… it’s too sporadic!

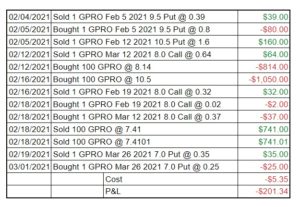

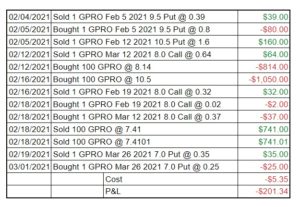

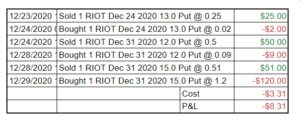

I can certainly attest to #1 – trading RIOT and GPRO. I checked them too often. GPRO got me a loss of $200! I don’t trade like that anymore, though technically it would now be within my 5% rule. At the time it was a much higher percentage of my pf.

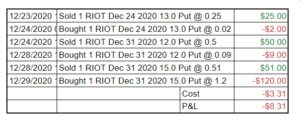

Even more volatile than GPRO was RIOT. Like its ticker, it turned into a riot. My loss was a lot smaller. But the chart is very volatile. That’s what kept me awake for these stocks. I’m lucky my education only cost $210.00!

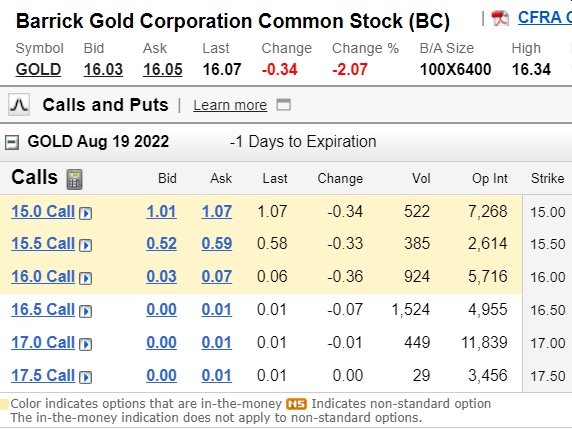

I can also verify that my trades in DBX have gotten bigger than I’d like, and gone on way longer than I’d like. I have got 400 but it’s like double what I intended, since I tried to rescue an opening trade too early. Sigh!

How do you manage your money or do you let the trades manage you?