I have been an online investor since 1998, but I have yet to make any serious money. I invested in the run up to the millennium, only to find myself too busy to take care of my stocks in the months following the peak. At one point, my holdings reached nearly $21K in value, but then in 2002 they collapsed to a little over $8K. Since then, with rising stock prices, and a change in philosophy, I’ve clawed my way back in several aspects.

Shifted to Dividend Bearing stocks

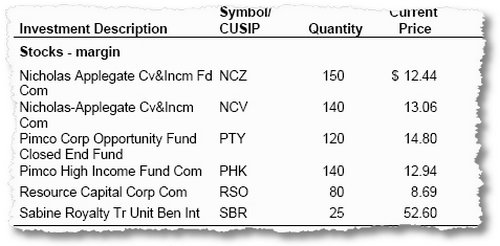

That was the biggest shift I made. And it now produces about $100 per month gross (before taxes) for my account, which is not a bad return on the current value. I’m currently holding these stocks in my dividend portfolio, some of which now offer very attractive dividend rates.

I actually don’t know how much sense this portfolio makes for other people, but somehow it is comforting when the stock market is being creamed to check your account and see a regular income in dividends from your stocks. After losing a lot in the dot com crash, I currently find this preferable to picking stocks out of thin air. This portfolio has varied been $11K and $14K in value over the past few years, but with me being over 15% still in cash, the returns have still been quite respectable.

Paying Off Loans

We’ve nearly paid off our car loan, and we’re likely to start making other changes to our personal finances in the coming months. We now are considering paying off our mortgage quicker than usual, and we have several creative options that we are looking at.

With about NT$2.3 million still outstanding, a rising interest rate, it is tempting to shift more money into paying off our mortgage. Clearly considering the opportunity cost is something we’ll have to look at. Do we need the money elsewhere? Our salaries haven’t increased much over the last five years, though our life quality has improved in many ways. Therefore, inflation hasn’t really helped to mitigate our mortgage payment much. Lower interest rates initially helped, but with higher inflation rates creeping through most people are beginning to feel the pinch with higher oil prices, utility and food payments, and mortgages.

In the Biz column

Our business is financially ticking along at a slightly higher notch than in the previous two years, but it still hasn’t generated enough free cash to really amount to much. I had the depressing experience of comparing our financials to a number of companies, and realized that our business, though light in debt, still is relatively under capitalized. We are profitable, we do manage to budget our expenses well, and we are consistently beating budgets, but we are still trying to make up for the last three years poor performance when costs jumped out of control, and sales stagnated (that’s a position I don’t want to be in again, I can assure you!).

So we’re looking at a number of options to boost our business’ coffers, including short-term lending, better term deposit rates, and shoring up income. This should help in the long term, but it’s going to be a few years, before we find ourselves in the ‘healthy financials’ column.

Online Business

It’s been quite exhilarating online to reach the US$10K mark in entire earnings. In fact, that money is now sitting in the bank, earning a pittance. I’m planning to start using the money to generate more money (it’s all part of a money cascade… part of my philosophy!) where trickles of income flow back to create waves, then torrents of cash! Who knows if it will work? Part of the money has already been used to buy a new stock in my portfolio – more details later. More of the money helped open a new CD in my bank at about 2.2% (the best available at the moment in NTD). But the bulk really is just sitting there.

The bigger challenge is finding a real product that I can sell: I’ve had some success as an affiliate for Amazon racking up nearly $1K worth of book sales, and other smaller incomes, but running this blog has proven that it’s quite difficult for me to convert clicks. How difficult? Well, I’ve yet to sign up a single affiliate for any of my hosting plans (BlueHost or Dreamhost); I haven’t any ClickBank sales either. I keep feeling that I should persist with this to figure out the way to do affiliate sales, so that future online business opportunities become possible…

Any suggestions?