Did the stock market plunge again? Are your positions wiped out or are you relishing the opportunity to find new entry points?

The 200 DMA crosses the 50 DMA: is that the death cross on 8/11? Updated

When I was a student in college many moons ago, I remember on Sunday outside chapel, and on selected weekdays, a seemingly old lady would parade up and down the street, offering pamphlets, protesting and trying to gain exposure for her world view that encompassed the imminent ending of the world…

A Brief Moment in 1987

And for one brief moment in 1987, the stock market plunge of October wiped out billions of dollars in a couple of sessions.

Just recently, if you’d been reading recent headlines on the Street, like this one, you’d be tempted to believe the same stock market plunge had just taken place again!

But is it? Is the end nigh? Or shall we all live again to trade and make money? Well, if you haven’t already guessed, I tend to the latter point of view. We will always prevail, perhaps a little wiser, certainly a lot poorer.

But we will all be investing again one day in the not too distant future, once we’ve licked our wounds after the current stock market plunge. At that moment, it might be hard to imagine as you and I are likely sitting on huge losses on our portfolios (I was down over 50% in 2008!)

Long way to go up – or down?

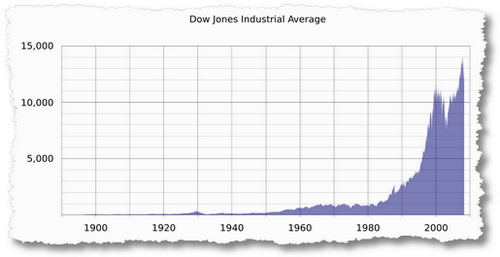

We should never use the past to judge the future, but previous statistics can be informative. The two most serious downturns in the 20th century were quite severe. The second crisis was in 1970’s when the Dow Jones dropped and the stock market plunge wiped out nearly 50% of the market value but what is worth noting: the greatest point loss (by points) was in fact only #17 in the total percentage losses.

In 2008 we were approaching a 45% downturn, and things have recovered well since then in the markets. There were only a few buyers out in the markets at the time, but many sellers so sell-orders swamped buy orders as companies, institutions, and individuals tried to unwind their risky positions, and save their skin. An awful lot of ‘unwinding’ was done before a more orderly market returned and there was more of a balance between buyers and sellers.

But in each of the downturns that occurred, people got back to business (eventually) and those downturn periods can hardly be seen in the chart above. But with markets still prone and intervention seeming not to work, we just have to figure out how to get from here and now to then.

Are we at the bottom, in the middle or at the top?

Many pundits are suggesting that the bottom of the market is not yet near, but that it is coming. While no one is sure of the exact time frame, several writers talk extensively about ‘capitulation’ – the notion that the selling is exhausted, and buyers’ orders match sellers’.

Jeff Cox of CNBC, writes “…But while hedge funds and industrial investors have been bailed out of positions, individual retail investors have still not reached the severe panic point.”

It’s quite likely most of us willl be steamrollered by the market as we jostle our buy/sell orders. I know I have: I now know the meaning of trying to catch a falling knife! He goes onto say that heavy volume will indicate that the capitulation phase has started, unfortunately we’re just not seeing that yet.

Cramer’s opinion always tells you what he thinks, EXACTLY. But you should take those opinions with a large pinch of salt!

So what is an successful trader/investor to do?

This is what I’m doing these days as I try to make sense of what’s going on, how I’m being affected by the latest stock market plunge, and where I’ll be in 12 months time:…

1. Keep eyes on your cash! It’s YOUR CASH!

Really, it’s just survival out there, that’s the name of the game now. Making sure that your cash is as safe as you can – verify that you have cash in the bank, that your bank deposits are sufficiently insured or guaranteed.

I’m planning to separate my funds into two bank accounts in separate institutions. While my own government authority has guaranteed deposits until 2010, having no access to these funds even temporarily could cause some cashflow problems, so I’d rather not take the chance.

2. Be better informed! Read, read, read…

I’m sure this is one that should affect us all! Here we are fretting about problems and issues that we all know little about: WTF is a Credit Default Swap? Well, since people are taking such risks with their money (and ours!), it seems that we have to all become better informed about the systemic risks these people are taking without so much as consulting us. I, for one, will endeavor to be much better informed about these matters.

3. Pie in the sky: that’s all it can ever be!

Skepticism has always been one of my strong suits, but now I’m becoming skeptical of the truisms, investing group-think wisdom, and aphorisms passed from advisor to client all over the world. I just don’t see why we should all be told that we have to invest in the stock market, expect 9% returns, and take SO MUCH risk without any chance of reward. No businessperson worth their salt would invest in a business like that.

Yet that is what most ‘retail investors’ face everyday. Yet every day, that investor is told to live with the risk of a stock market plunge wiping out not just some of the portfolio, but a lot of it! There will always be the risk of a stock market plunge! …

I’ll be adding to this discussion shortly, but I wonder: how were you affected by the crash? What are you doing to protect your investments? How do you see things now in view of the possible double dip that a lot of people are talking about?